LONDON — The UK National Wealth Fund announced today that it has identified priority sectors for targeted economic support, signaling a strategic effort to bolster growth, create jobs, and strengthen the nation’s long-term industrial base. The fund, designed to leverage public capital for strategic investment, has highlighted hydrogen energy, steel manufacturing, and carbon capture technologies as key areas for investment over the coming years.

Officials from the Treasury emphasized that these sectors have been selected based on their potential to drive sustainable growth, enhance the UK’s competitive position globally, and address urgent environmental concerns. The initiative aligns with the government’s broader industrial strategy, which seeks to modernize infrastructure while supporting innovation and green energy solutions.

Hydrogen technology is expected to play a critical role in the UK’s transition to a net-zero economy. By providing financial incentives and investment support, the fund aims to accelerate the development of production facilities, distribution networks, and commercial applications. Analysts suggest that this focus could position the UK as a leader in clean energy, creating thousands of high-skilled jobs and stimulating associated sectors.

Steel production, a cornerstone of the nation’s manufacturing capacity, has also been identified as a priority. The fund plans to support modernization efforts, including investments in energy-efficient production methods and advanced materials research. Officials stress that maintaining a strong domestic steel industry is vital for national infrastructure projects, defense applications, and export potential.

Carbon capture and storage technologies, meanwhile, are receiving increased attention as the UK seeks to meet ambitious climate targets. By funding pilot projects, commercial-scale plants, and innovative research, the government aims to reduce industrial emissions and position the UK at the forefront of global climate solutions. “This is about investing in industries that not only create economic value but also address our environmental responsibilities,” a spokesperson said.

Economic analysts have welcomed the announcement, noting that strategic investment in high-impact sectors can drive innovation while mitigating risks associated with global market volatility. “Focusing on hydrogen, steel, and carbon capture reflects a pragmatic approach,” said a leading economist. “These sectors have the potential to deliver both economic and environmental benefits.”

However, some critics argue that public funds must be carefully monitored to ensure transparency, efficiency, and equitable outcomes. Calls for independent oversight and performance metrics have been made to prevent misallocation of resources and to ensure that investments deliver measurable results.

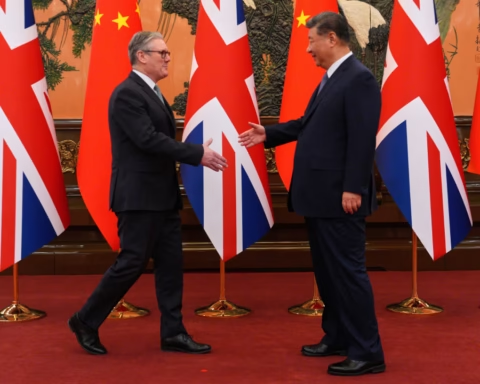

The announcement also coincides with broader efforts to attract foreign direct investment, highlighting the UK’s ambition to maintain a competitive edge in emerging industries. By showcasing commitment to green energy and advanced manufacturing, policymakers hope to send a strong signal to international partners, encouraging collaboration and investment.

Industry leaders have expressed cautious optimism, highlighting that government support could accelerate technological development and reduce the financial risk for private investors. In particular, partnerships between established corporations, startups, and academic institutions are expected to foster innovation and knowledge transfer.

The National Wealth Fund’s targeted strategy reflects a broader trend among advanced economies to deploy public resources strategically, balancing short-term economic stimulus with long-term industrial policy. Observers note that success will depend on careful project selection, risk management, and collaboration between government, private sector, and research institutions.

As these initiatives unfold, policymakers, investors, and industry stakeholders will closely monitor outcomes, seeking to measure progress in job creation, technological advancement, and emissions reduction. The fund’s focus on high-impact sectors underscores the UK’s ambition to remain competitive, resilient, and environmentally responsible in a rapidly changing global economy.